Can your financial plan stand the test of time? It may need to last longer than you think. By 2030, it’s estimated that adults aged 80 years and older could grow to 19.5 million — a 109% increase from 2000.

Depending on how well you’re prepared, this “longevity bonus” is both a benefit and a challenge. People aren’t sure how to plan for the obligations they’ll face in the future. According to surveys, outliving their savings in retirement is a significant fear and even a fate worse than death.

The latest estimates anticipate a healthy couple could spend $275,000 on health care in retirement — and this may be more or less depending on their health status, where they live, and how long they live.

Since longevity doesn’t always mean extra healthy years, I was invited to explain how we can live longer without growing “older”. Six in 10 Americans has a lifestyle disease, that is, they suffer from a condition that is a consequence of how they’ve lived their life.

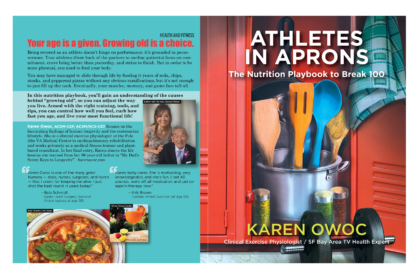

Your age is a given. Growing old is a choice.™

In case you missed my radio interview on functional longevity that aired on Don’t Invest and Forget with Pat Vitucci, you can hear it here. What’s the connection? Planning for your longevity is as important as planning for your financial future.

Audio Player Pat Vitucci has been a leader in the financial services industry for more than 30 years. He shares his message of proactive, goals-based financial planning with a wide audience throughout the Bay Area with his weekly radio show, television programs, and live seminars.

Pat Vitucci has been a leader in the financial services industry for more than 30 years. He shares his message of proactive, goals-based financial planning with a wide audience throughout the Bay Area with his weekly radio show, television programs, and live seminars.

He is also a popular guest speaker at conferences and workshops. Pat is the author of Don’t Invest and Forget™, which outlines the importance of having a comprehensive financial plan – and how to start building one.

Air Date: 3/27/22 and 3/28/22